Exploring Options: Can Former Bankrupts Secure Credit History Cards Adhering To Discharge?

Navigating the monetary landscape post-bankruptcy can be a daunting task for people aiming to rebuild their credit report. One usual question that occurs is whether previous bankrupts can successfully get credit history cards after their discharge. The solution to this questions involves a multifaceted exploration of different variables, from charge card choices customized to this market to the influence of previous economic choices on future creditworthiness. By understanding the complexities of this process, individuals can make educated decisions that may pave the way for a much more protected monetary future.

Recognizing Credit Rating Card Options

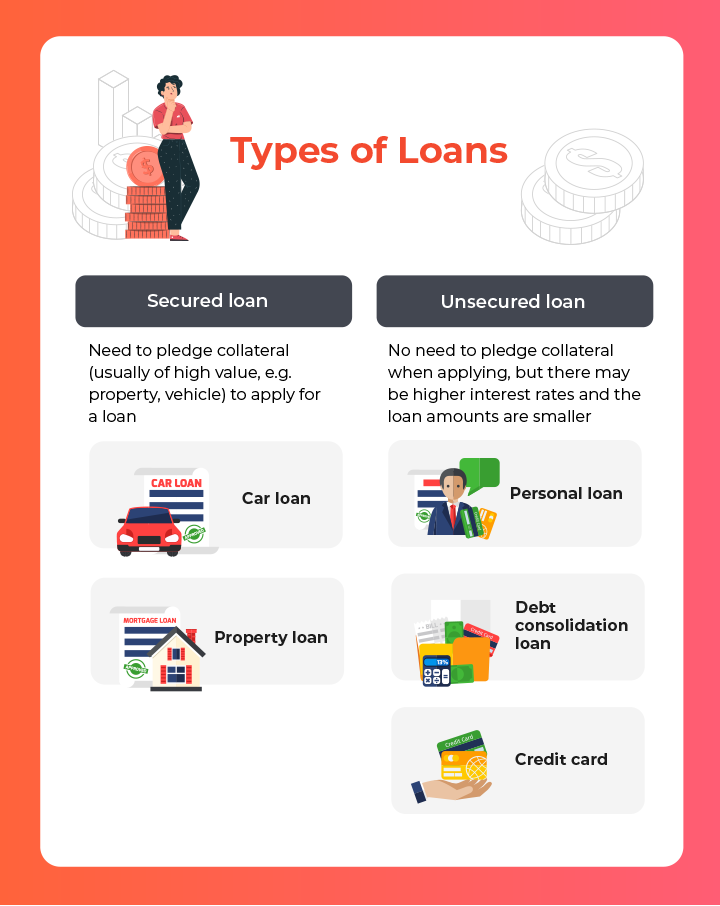

When thinking about credit report cards post-bankruptcy, individuals have to meticulously examine their requirements and financial scenario to choose the most ideal choice. Protected credit rating cards, for circumstances, require a money down payment as collateral, making them a practical selection for those looking to restore their credit rating history.

Additionally, individuals ought to pay close interest to the interest rate (APR), moratorium, annual fees, and rewards programs provided by different bank card. APR dictates the price of obtaining if the balance is not paid completely each month, while the moratorium determines the home window throughout which one can pay the equilibrium without sustaining passion. Furthermore, yearly charges can affect the total cost of owning a bank card, so it is critical to evaluate whether the benefits outweigh the charges. By thoroughly assessing these aspects, people can make enlightened choices when picking a charge card that lines up with their financial goals and situations.

Factors Affecting Approval

When requesting credit cards post-bankruptcy, understanding the elements that impact authorization is vital for individuals looking for to reconstruct their economic standing. One vital element is the candidate's credit report. Adhering to a bankruptcy, credit rating frequently take a hit, making it tougher to qualify for typical charge card. Nevertheless, some providers provide safeguarded charge card that call for a deposit, which can be an extra achievable alternative post-bankruptcy. Another considerable variable is the applicant's earnings and work status. Lenders desire to ensure that individuals have a steady revenue to make timely repayments. In addition, the length of time given that the bankruptcy discharge plays a function in approval. The longer the period given that the bankruptcy, the greater the chances of authorization. Demonstrating accountable economic behavior post-bankruptcy, such as paying costs on time and maintaining debt use reduced, can likewise positively influence bank card authorization. Comprehending these variables and taking steps to boost them can boost the likelihood of safeguarding a charge card post-bankruptcy. secured credit card singapore

Safe Vs. Unsecured Cards

Guaranteed credit rating cards need a cash money down payment as collateral, typically equal to the credit score limit extended by the company. These cards normally supply greater credit scores limitations and lower rate of interest prices for people with excellent credit history scores. Eventually, the option in between protected and unprotected credit cards depends on the individual's financial situation and credit history goals.

Building Credit History Sensibly

To successfully rebuild credit score post-bankruptcy, establishing a pattern of responsible credit report usage is crucial. Additionally, maintaining credit score card equilibriums reduced family member secured credit card singapore to the credit history limit can favorably influence credit score scores.

One more method for constructing credit report sensibly is to keep track of credit rating reports routinely. By evaluating debt records for errors or signs of identification burglary, individuals can resolve concerns immediately and preserve the precision of their credit report. In addition, it is a good idea to avoid opening numerous new accounts simultaneously, as this can signal economic instability to prospective loan providers. Instead, concentrate on progressively diversifying credit history accounts and demonstrating consistent, responsible credit history habits gradually. By following these practices, individuals can slowly restore their debt post-bankruptcy and work towards a much healthier monetary future.

Enjoying Long-Term Perks

Having established a structure of responsible credit rating management post-bankruptcy, people can currently concentrate on leveraging their improved credit reliability for long-term monetary advantages. By regularly other making on-time settlements, keeping credit rating utilization reduced, and monitoring their credit scores records for accuracy, former bankrupts can slowly rebuild their credit scores. As their credit history boost, they may end up being qualified for better credit report card uses with lower rates of interest and greater credit line.

Gaining long-lasting benefits from enhanced credit reliability extends past simply credit rating cards. Furthermore, a positive credit rating account can boost job prospects, as some companies may examine credit scores records as part of the hiring procedure.

Conclusion

Finally, former insolvent individuals might have problem protecting bank card complying with discharge, but there are alternatives available to assist restore debt. Comprehending the various sorts of credit cards, factors influencing approval, and the importance of responsible credit report card use can assist individuals in this scenario. By picking the ideal card and utilizing it responsibly, previous bankrupts can progressively improve their credit history and reap the long-lasting benefits of having access to debt.

Showing liable economic habits post-bankruptcy, such as paying expenses on time and maintaining credit rating application reduced, can additionally positively affect debt card approval. Furthermore, maintaining credit history card equilibriums reduced relative to the credit report restriction can favorably affect credit scores. By constantly making on-time repayments, keeping debt use reduced, and monitoring their credit rating reports for accuracy, previous bankrupts can slowly restore their credit score scores. As their debt scores increase, they may become eligible for better debt card provides with lower interest rates and greater credit rating limitations.

Understanding the various kinds of debt cards, elements affecting authorization, and the significance of liable credit report card use can assist people in this circumstance. secured credit card singapore.